Silver Market Intelligence Briefing

What We’re Seeing in the Market Right Now — And What Silver Holders Should (and Shouldn’t) Do

By John Cimral — Owner -Trophy Point Coins

Date: February 1, 2026

Visit: Trophy Point Coins

---

The Trophy Point Coins Value Proposition (Read This First)

At Trophy Point Coins, our mission is straightforward:

Give clients real-world intelligence, not hype

Protect long-term wealth, especially inherited or large holdings

Provide disciplined, data-driven guidance, not emotional reactions

Operate with full transparency even when the market is chaotic

Treat clients as long-term partners, not transactions

What follows is the most accurate snapshot of the market we’ve seen since the crash — based on what we witnessed directly at the Olympia Coin Show and what we did *not* see from wholesalers, bulk buyers, and institutional accumulation desks.

This is intel, not theory.

---

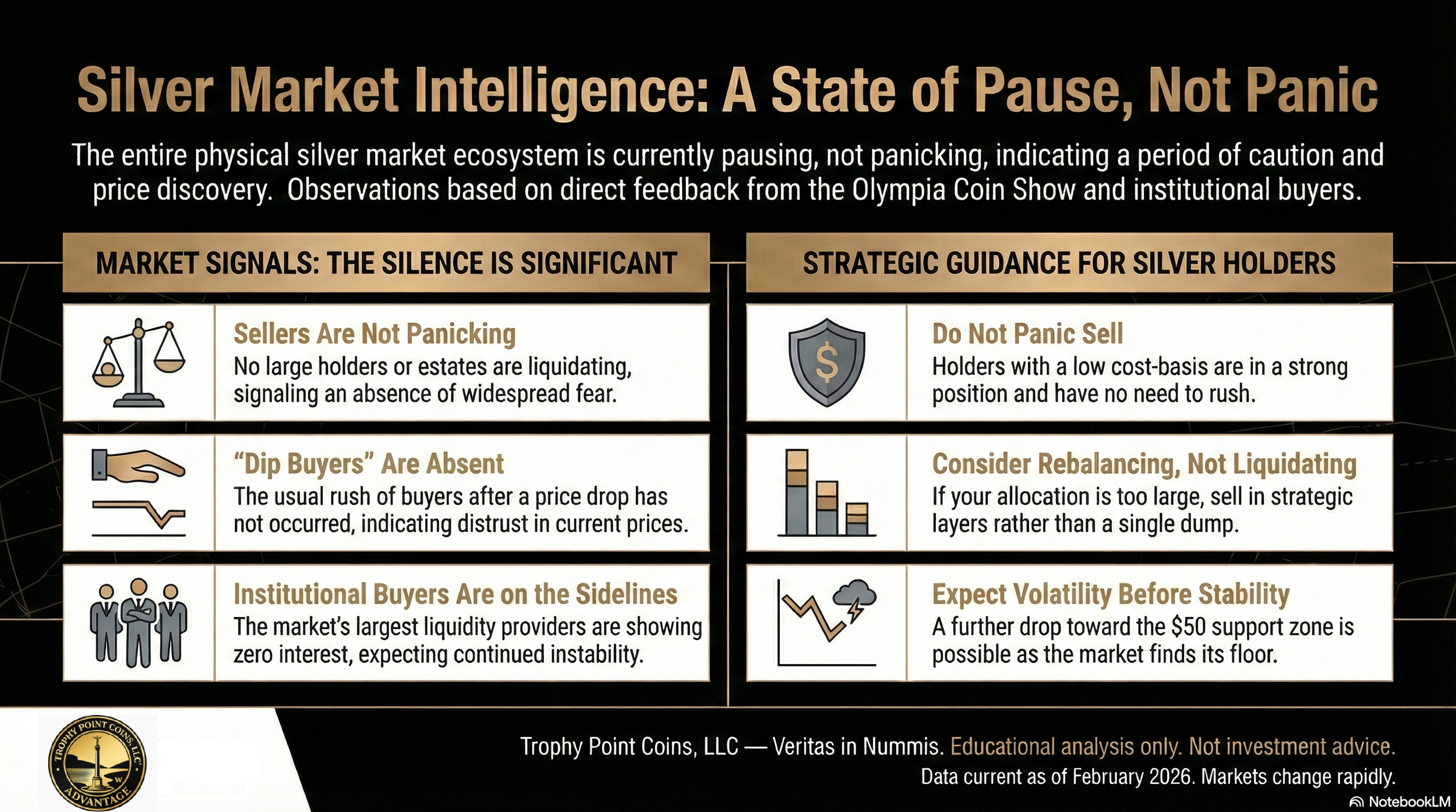

1. What the Coin Show Told Us: Fear Isn’t Showing Up

The Olympia show was a perfect pressure-test of real-world sentiment.

And the most important signals weren’t the trades happening on the floor…

but the people who didn’t show up.

A. No Hoard Dumpers

Not a single estate, inherited stash, or major holder walked in with panic liquidation.

That tells us:

No widespread fear

No capitulation

No “race to the exits”

The crash didn’t trigger forced selling.

That’s extremely important.

*B. No Stackers Buying the Dip

Normally, dip-buyers storm in.

Not this time.

Their absence indicates:

Expectation of continued volatility

Lack of trust in the current price level

Fear of catching a falling knife

C. No Bulk Buyers Sweeping the Floor

On a normal show weekend, wholesalers and arbitrage buyers are the first to exploit dislocations.

This weekend: **zero activity**.

That silence from smart money is meaningful — and consistent with what we saw from the big buyers (next section).

---

2. The Big Buyers Didn’t Bark — And That Tells You Everything

Before the weekend, we reached out to multiple large buyers — the kind who normally pounce on panic spreads, distressed selling, or estate selloffs.

This time?

Nothing.

No bids.

No questions.

No interest.

Not even a “keep me posted.”

When the largest liquidity providers go quiet, it means:

* They don’t trust the current pricing

* They expect continued instability

* They’re waiting for lower levels

* They believe time is on their side

This matches the lack of activity seen on the floor.

The entire ecosystem is pausing — not panicking.

---

3. Guidance for Clients With Bulk Hoards or Old Silver Stashes

If you own:

* Monster boxes

* Old family hoards

* Large bullion accumulations

* Decades-old holdings bought far below current levels

…here’s the clear and calm guidance:

A. Do NOT panic sell.

You’re sitting on material bought at levels dramatically lower than 2020–2026 pricing.

You have **no need** to rush.

B. Consider “rebalance,” not “liquidate.”

If your silver allocation has grown too large relative to your portfolio, then *yes* — this is the moment to think strategically.

But strategy means:

* Setting targets

* Planning timing

* Avoiding blind liquidation into thin demand

* Protecting tax position

* Selling in layers, not dumps

C. Expect Weeks — Not Hours — for Market Stabilization**

The buyers who matter have not returned yet.

The buying floor hasn’t rebuilt.

The bid-side confidence isn’t restored.

This will not resolve Monday morning.

It may take **multiple weeks**.

D. Prepare for $50 Silver Before Stability Returns

Another leg down toward **the next support zone near $50** should not surprise anyone.

That’s not doom — that’s structural reconsolidation.

E. Do NOT expect $117 again soon.

That spike was an emotional overshoot, not a fundamental base.

Strong rallies require strong bid depth.

Right now, that depth simply isn’t there.

F. And talk of $200 silver?

That’s not analysis. That’s hope or desparation talking.

And hope is not a strategy.

4. What Trophy Point Coins Recommends Right Now

Here’s the distilled version:

* **Hold** your old hoards

* **Rebalance slowly**, if needed

* **Avoid panic**

* **Expect choppy markets for weeks**

* **Let buyers re-emerge before making big moves**

* **Consider consulting us for timing, grading, or structuring**

Our job is to help you act with discipline, not emotion.

---

5. Final Thought

The calm you’re seeing is not complacency — it’s caution.

Buyers are waiting.

Sellers are waiting.

Everyone is breathing in, not breathing out.

This is the moment for patience and planning, not prediction.

And if you want help evaluating your position — whether selling, holding, or reorganizing — we’re here.

6. Legal & Plain-English Disclaimer

Let’s keep this simple:

**We are NOT financial advisors.**

We do NOT give investment advice, retirement guidance, or securities recommendations.

As Dr. McCoy might say:

“Damn it, Jim — I’m a doctor, not a poodle.”

In our case:

“Damn it, Jim — we’re coin dealers, NOT financial planners.”

Everything above is market intelligence and operational guidance based on what we observe in the physical coin ecosystem — not securities advice.

Always consult your licensed financial professional for investment decisions.

C